Introduction

The continued evolution of precision medicine is creating tremendous change in the pharmaceutical industry. For example:

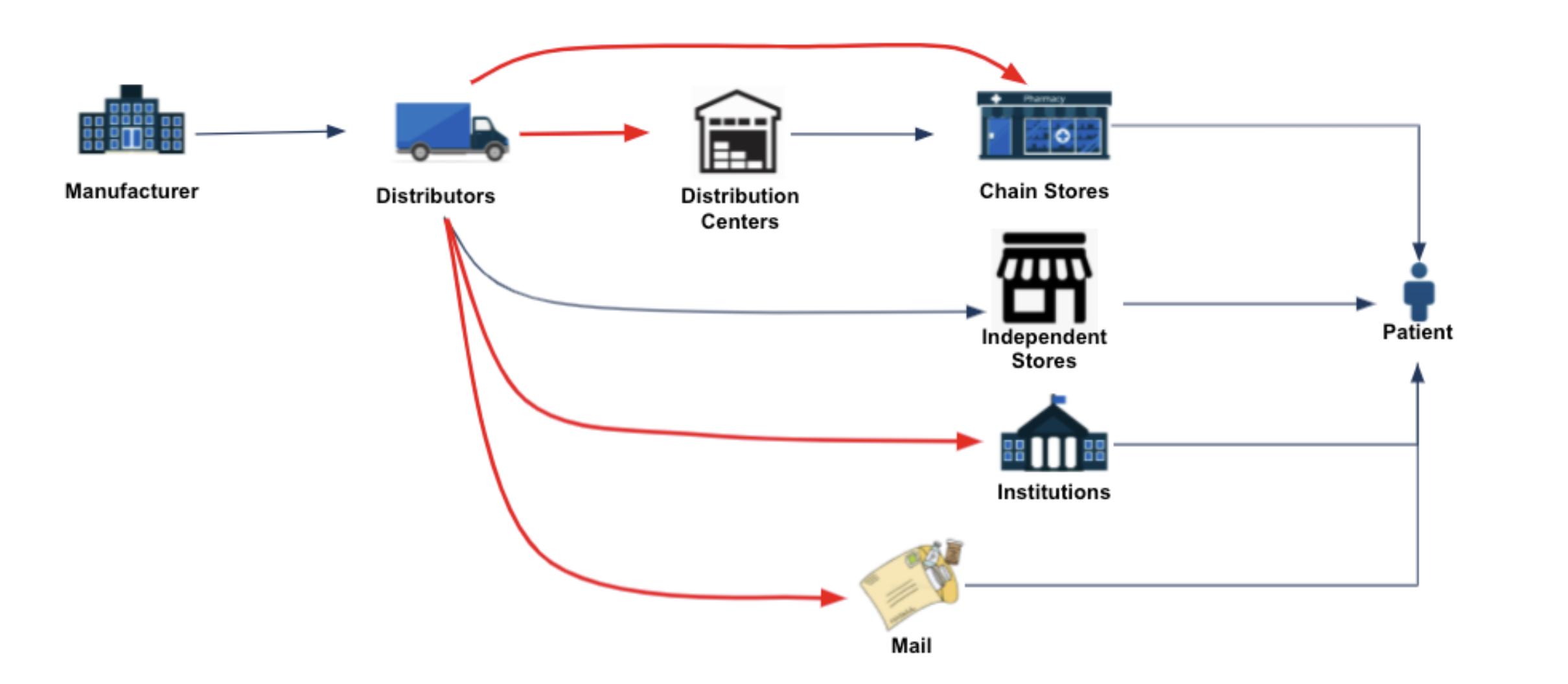

- Traditional retail distribution has given way to a wide array of buy-and-bill, specialty pharmacy, spec-tail, and specialty-lite channel designs.

- Drugs and therapies may be covered by medical benefit plans instead of pharmacy plans, so there is no actual prescription. Prescriptions may not be going through retail pharmacy and therefore, the data isn’t in the network that is accessed by data syndicators.

- Patient initiation and adherence continue to be a major issue; Adherence rates for most medications for chronic conditions such as diabetes and hypertension usually fall in the 50% to 60% range, even with patients who have good insurance and drug benefits.

As a result, pharmaceutical manufacturers of all size and complexity are re-assessing their drug commercialization strategies, and this begins with their data. It’s not an understatement that most manufacturers have been collecting and analyzing their channel, patient, and payer data the same way for years. However, as we spoke of in previous blog posts, data aggregation is becoming more of a backbone of commercial life sciences analytics than ever before.

The Commercial Data Visibility Gap

Most pharmaceutical manufacturers have relied on syndicated data to drive their channel, patient journey, and contract decision-making. Unfortunately, syndicated data is of little use for gross-to-net, channel design/mix, and inventory/returns forecasting for several reasons:

- Tends to be weeks behind EDI data

- Data isn’t actuals, it’s projected based on their survey

- Lacks data for direct sales, blinded indirect sales, many independent pharmacies, long-term care (LTC), and government channels.

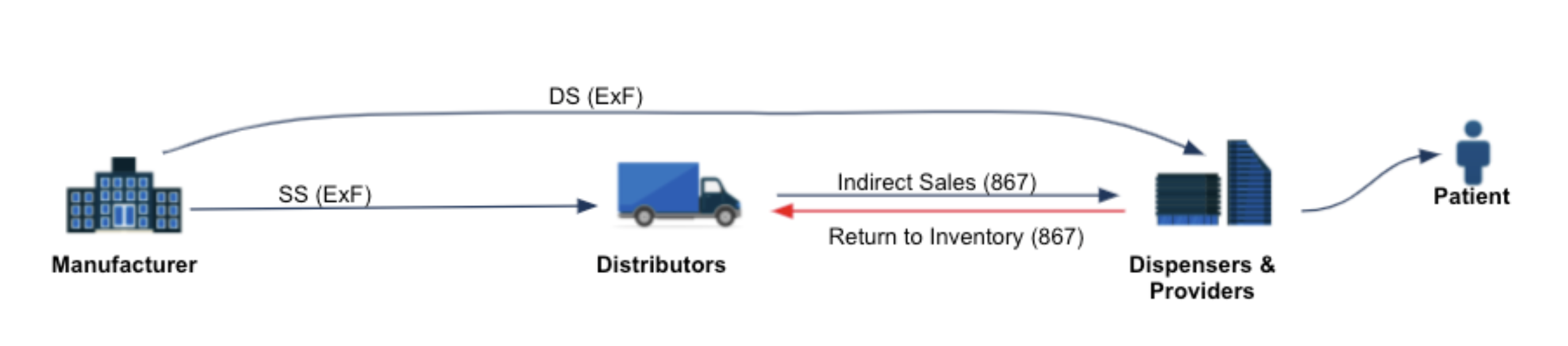

Increasingly, manufacturers are turning to a combination of 867 and ex-factory sales data to give them a trusted line-of-sight into the volumes going out, inventory levels, returns, etc (as shown below):

Unfortunately, 867 is routinely blinded by trading partners, which can dramatically limit its effectiveness. Some examples of data redaction include:

- Only the first three digits of a postal code are provided (e.g, “085xx”)

- Aggregating sales to a geographic area at a weekly level, instead of providing transaction-level detail (e.g. “1.500 units sold into zip code 085xx during the week of 8/16”)

- Excluding the record from 867 altogether!

This limited visibility frustrates/hampers market access teams in a number of ways:

- The team has little visibility into where their products are being sold as well as where they are not. The team needs this information to identify where they may need greater marketing focus as well as to rapidly and proactively identify and resolve potential product availability issues. (see diagram above – red arrows indicate commonly blinded distribution)

- The data isn’t actionable. Market access teams can attempt to fill the gaps by making educated guesses or pay for data feeds directly from pharmacies, but these can lead to expensive contracts, or costly forecasting errors.

- Getting an accurate handle on downstream inventory levels (which are a critical element in determining net prices) becomes even more difficult without full visibility.

Data Unblinding Today and Tomorrow

IntegriChain was the pioneer for data aggregation and refinement and hundreds of pharmaceutical manufacturers rely on IntegriChain solutions. However, many manufacturers are now directly contracting for additional dispensing data from their pharmacies and GPOs (including digital pharmacies, independent pharmacy networks, retail community, integrated system specialty pharmacies, and long-term care), IntegriChain has new options to enhance the precision of unblinding 867. The obvious benefit is greater visibility to demand pulse and better inventory pipeline for GTN predictability. Some of these new options include:

- Use of Chargeback Data. When the pharmacy purchases units from the wholesaler, the wholesaler might be selling those units at a lower price than the wholesale acquisition cost (WAC) they paid. Since every chargeback links back to a related 867 sale, IntegriChain solutions and analysts leverage a combination of 844 and 849 chargeback data from our whole universe of manufacturers to be able to deduce the actual ship-to location details behind blinded 867 transactions. As one of the largest data aggregators in the industry, we can do this at a much higher scale than anyone else.

- Overlay of 852 and 867 Data. 852 data reveals the actual amount that was sold; it isn’t reduced by the amount that was blocked or excluded from the 867. That’s just actually how many units that went out the door that day. With that in mind, we can look at a trended view and compare what the 852 and 867 data is telling us and any gap is likely to be blocked or excluded sales. Once we have this quantity, by relying on our internal repository of pharmacy and warehouse locations, we can figure out where in the country these units were shipped. Sure, it’s a lot of detective work, but it is critical to unlocking the value in the data.

- Data Science. Another technique we employ is called size unblinding. Even with just the first three digits of a postal code, we can apply machine learning and statistical models to accurately determine which pharmacy likely made the purchase.

Conclusion

The pharmaceutical industry is changing faster and more dramatically than ever before. As a result, traditional market access strategies are breaking, not just bending. Data aggregation is no different. Traditional approaches to data aggregation and unblinding are no longer sufficient and IntegriChain continues to make significant investments in data science and machine learning to address these challenges.

Learn more about how IntegriChain is changing the game around data unblinding with Data Aggregation 3.0