Table of Contents

- Understanding Bona Fide Service Fees & Their Role in Government Pricing

- Evolving Pharma Industry Challenges the Future of FMV Analysis

- Best Practices for FMV and BFSF Compliance

At Access Insights 2024, industry leaders came together to discuss the evolving landscape of Fair Market Value (FMV) and Bona Fide Service Fees (BFSF) in pharmaceutical contracting. With new regulatory pressures, vertical integration among market players, and an increased focus on government pricing, these considerations have never been more critical for manufacturers navigating fair market value pharma compliance.

In this blog, we recap the key insights shared by Nick Lynch, Partner at IntegriChain, and Suriya Janarthanan, Associate Director at Novartis, on how pharma manufacturers can navigate FMV and BFSF complexities to ensure compliance and optimize their market access strategies.

Understanding Bona Fide Service Fees & Their Role in Government Pricing

Pharmaceutical manufacturers are required to evaluate bona fide service fees paid to customers, purchasing agents, and other commercial channel organizations. This is part of Government Price Programs (“GP”) reporting regulations and requirements and Anti-Kickback Statute compliance and regulations. These fees, as outlined by Centers for Medicare & Medicaid Services, determine how payments made to trading partners impact key pricing calculations such as Average Manufacturer Price, Best Price, and Average Sales Price. Therefore, it is essential for manufacturers to analyze these fees through the lens of bona fide services compliance.

Nick and Suriya emphasized a critical point: The process, approach, evaluation, and documentation of whether a fee is bona fide or not is just as important as the actual result. As a reminder, a payment being classified as bona fide or non bona fide does not make it illegal or wrong. There may be other legal/compliance considerations, and we recommend getting counsel input where needed) —but it does change how it factors into government price reporting, gross to net, and reimbursement.

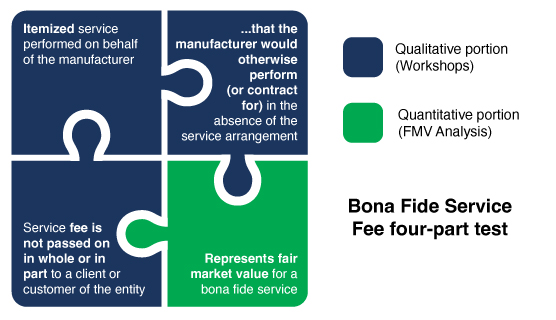

CMS Bona Fide Service Fees (BFSF) Test

To be considered a bona fide service fee, it must satisfy each of the following four criteria, as set forth by the Centers for Medicare & Medicaid Services (CMS) and pursuant to 42 C.F.R. §§ 414.802 and 447.502

- The fee paid must be for a bona fide, itemized service that is actually performed on behalf of the manufacturer

- The manufacturer would otherwise perform or contract for the service in the absence of the service arrangement

- The fee represents Fair Market Value (FMV) for the services rendered

- The fee is not passed on in whole or in part to a client or customer of any entity

Figure. 1 – CMS Bona Fide Service Fees Test

The Department of Veterans Affairs has additional guidance, though it remains outdated (last formalized in 2006-2007). With recent regulatory shifts, non-FAMP (Federal Ceiling Price) calculations are under increasing scrutiny, making FMV and BFSF determinations even more complex.

Why Bona Fide Service Fees Matter Now More Than Ever

Bona fide service fee assessments have direct implications on gross-to-net calculations, reimbursement rates and remuneration within supply chain arrangements, compliance risk, and overall profitability. As litigation and government scrutiny increase, it is no longer acceptable for companies to take a blanket approach by categorizing all payments as either discounts or service fees.

In some cases, manufacturers misclassify fees, leading to underreported ASP, incorrect AMP calculations, and potential legal challenges. A well-documented process is critical for defensible pricing strategies.

Evolving Industry Challenges and the Future of FMV Analysis

Manufacturers now work a variety of service providers across distribution, pharmacy network, PBMs, GPOs, and emerging data partnerships. Recent market shifts, including vertical integration among major distributors and PBMs, add complexity to the BFSF evaluation process.

With new GPO models, companies must assess whether admin fees, marketing arrangements, or data-sharing agreements impact best price calculations. The challenge? Pass-through provisions are often unclear, making compliance risk higher than ever.

Fair Market Value in Pharma: Finding the Right Approach

The quantitative portion of the Bona Fide Service Fees (BFSF) test, Fair Market Value, is often the most complex and debated. In the world of FMV pharma valuation, there are generally three approaches (see below). In the service fee and BFSF world, both the cost approach and or market approach are considered. We recommend considering multiple approaches where possible for accurate, fair market value pharma assessments.

- Cost Approach – Evaluates the direct and indirect costs associated with the service.

- Market Approach – Benchmarks fees against comparable industry transactions.

- Income Approach – Estimates the present value of future cash flows expected to be generated by the business or asset. Less commonly used in service fees since it assumes that the value of the service is directly related to its ability to generate future income, and such correlation is often not defined in-service fee arrangements.

A key takeaway is that CMS does not provide explicit fair market value pharma guidelines. Instead, manufacturers must document their methodology and ensure consistency across agreements.

Best Practices for FMV and BFSF Compliance

Nick and Suriya outlined several best practices for ensuring an effective and compliant BFSF and FMV pharma process:

Early Engagement with Market Access and Legal Teams

- FMV pharma strategies should be considered in early

- Legal teams should be involved, particularly in new contract structures.

Standardized Process for BFSF and FMV Evaluations

- Establish a clear workflow for BFSF assessments across vendors and contracts.

- Ensure periodic fair market value (FMV) pharma updates (every 2-3 years, or sooner for market shifts).

- Provide periodic trainings at least once a year to stakeholders involved in the process.

Technology-Driven FMV Pharma Analytics

- Companies must leverage technology for process automation and analytics.

- Creating a centralized repository of documentation (i.e., FMV/BFSF) pertaining to a vendor contract.

- AI-driven contract assessments can streamline compliance and identify pricing risks.

Proactive Monitoring of Vertical Integrations

- Stay informed on distributor-PBM mergers and how these affect pricing structures and new entities that may need to be evaluated from a BFSF perspective.

- Watch for new service agreements that could inadvertently impact government price reporting.

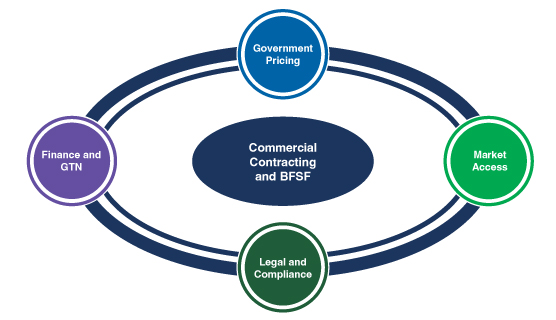

Key Components of Commercial Contracting & Bona Fide Service Fees

Figure. 2 – Commercial Contracting and Bona Fide Service Fees

Looking Ahead: The Future of BFSF & FMV

With increasing pricing pressures, government scrutiny, and evolving service models, manufacturers cannot afford to take a reactive approach. The best-in-class organizations are leveraging bona fide service fees and fair market value pharma as strategic tools, not just compliance requirements.

- Integrated FMV & BFSF systems will become the new standard.

- Real-time analytics will improve visibility into service fee allocations.

- Cross-functional alignment (Market Access, Legal, Finance) will drive pricing optimization.

Manufacturers must document, validate, and consistently apply fair market value (FMV) pharma and bona fide service fees (BFSF) methodologies to safeguard compliance and profitability. IntegriChain continues to lead the charge in FMV and BFSF strategy, providing manufacturers with the insights, analytics, and technology needed to navigate this ever-changing landscape.

For more information on fair market value, bona fide service fees, and how IntegriChain can assist your organization, contact nlynch@integrichain.com.