Editor’s Note: This month, we offer updates on three topics: IRA Part D Redesign Financial Implications, New Gene Therapies Give Newfound Hope for Patients, and Impact of Credit Card Fees in Government Pricing. As always, if you have questions on any of the content found in this or previous market updates, please reach out to your IntegriChain Consulting Lead or consulting@integrichain.com and we would be happy to talk you through it.

Table of Contents

- IRA Part D Redesign Financial Implications to Pharma Manufacturers and Payers/Plan Sponsors

- New Gene Therapies Give Hope for Patients While Creating Challenges for the Healthcare System

- Impact of Credit Card Fees on Government Pricing: Regeneron Case

IRA Part D Redesign Financial Implications to Pharma Manufacturers and Payers/Plan Sponsors

The Inflation Reduction Act (IRA) of 2022 represents a significant legislative effort aimed at addressing various economic issues, including healthcare costs.

A recap of some significant changes in the legislation are:

- Manufacturer negotiation of drug prices with Centers of Medicaid & Medicare Services (CMS) for select high expenditure drugs that currently do not have generic or biosimilar competition starting in 2026

- Cap on price increases above the rate of inflation for drugs sold to Medicare (started in 2023)

- Redesign of the Medicare Part D prescription drug benefit structure by replacing the Coverage Gap Discount Program (CGDP) with the new Manufacturer Discount Program (MDP) to take effect in 2025

The key component of this act is its impact on the healthcare sector, particularly in terms of financial dynamics between Part D plans, Medicare patients, and drug manufacturers. The main objective of the legislation is to shift costs from the government and patients over to pharmaceutical manufacturers and Part D plans. While we are in the midst of the storm, and the brunt of the financial implications are yet to be felt, manufacturers can look to forecast and evaluate their financial impacts, product lifecycle implications, and payer economics.

While the impact to manufacturers will vary by product archetype, price, indication, and co-morbidity factors, their liabilities are anticipated to increase (substantially in some cases). Lower priced brand drugs subject to MDP will stay in the initial coverage period longer and higher price brand drugs, such as specialty drugs, will result in five or more times the liabilities compared to what they encountered in the past.

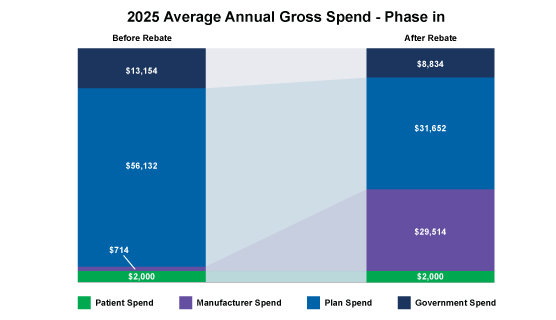

It is important to note that the MDP will be phased in for small manufacturers, potentially lowering their initial impacts; however, this would create greater downstream implications to the Part D plans.

The Impacts of the Part D Redesign

Part D plans currently utilize both manufacturer rebates and federal government capitated payments to lower their overall net costs (to keep their profit margins high).

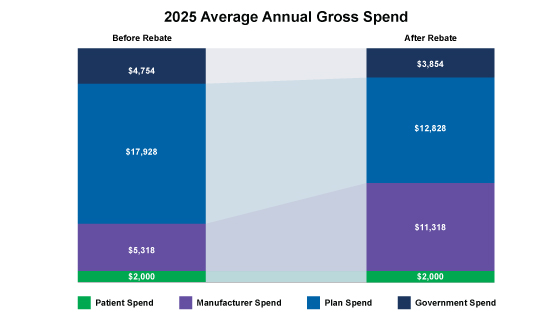

Starting in 2025, we can see how the financial impacts of the Part D redesign affect plans and will start to shift assuming manufacturers with a high-cost specialty drug and no phase-in:

- Note: The illustrations below include the plan direct and indirect remuneration (DIR) rebate shared with the federal government.

Figure. 1 – 2025 Average Annual Gross Spend

However, the financial impacts to Part D plans change considerably when we consider manufacturers with a high-cost specialty drug AND with a phase-in:

Figure. 2 – 2025 Average Annual Gross Spend – Phase In

As depicted above, the plan’s costs are greatly influenced by manufacturer rebates; thus it’s crucial for manufacturers to understand not only the market basket and the payer economics when entering into negotiations with Part D payers but also the financial impacts of the IRA to make smart strategic decisions.

IntegriChain has expertise in managing and modeling the IRA implications. If you are interested in running a financial assessment, payer economics and market landscape evaluation, please reach out to Consulting@IntegriChain.com or contact your Advisory lead.

References:

New Gene Therapies Give Hope for Patients While Creating Challenges for the Healthcare System

Gene therapies are garnering FDA approval at a rapidly increasing pace. By 2032, 85 new gene therapies-across 12 therapeutic areas-are expected to receive regulatory approval.

These new therapies offer curative, single-dose treatments that are drastically changing how we view and measure long-term healthcare and societal cost effectiveness. The cost effectiveness of these therapies considers:

- A significantly extended, improved and/or restored lifespan and quality of life

- Reduction and/or elimination of lifetime direct healthcare costs

- Reduced and/or elimination of lifetime indirect healthcare costs

- Restoration of societal engagement through jobs and subsequent economic contributions

These benefits tie directly to the high list prices for these therapies currently exceeding $4 million. As new gene therapies move through the pipeline are expected to cost $35 to $40 billion, in aggregate over the next decade, we will see manufacturers, payers and regulatory bodies (such as Congress, CMS, States, etc.) be tested in their ability to adapt to a changing therapy landscape.

Challenges the Gene Therapies Create in the Current HealthCare Model

The traditional healthcare model is best equipped for a patient to be ill, receive a diagnosis, and then receive a drug over a period of cycles and/or a lifetime for management/maintenance. Financial risk is distributed over a large timeframe and number of patients. These therapies tend to fall under traditional clinical trial models and subsequent patient benefit determinations.

However, gene therapies are not afforded the same standard clinical trial design and certainly not the lifetime horizon these therapies theoretically can offer. Clinical uncertainty, coupled with a high upfront cost is forcing manufacturers, payers and relevant regulatory bodies to potentially consider novel strategies such as:

- Lower initial launch pricing until benefits are more validated

- Integrated special ethical priorities into value based pricing

- Shared savings between manufacturer and payer/society in value based agreements (VBA)

- Enhanced ability for VBA implementation, testing, tracking, and improvement

- Average Sales Price (ASP) regulatory update to treat VBA’s similar to Medicaid’s multiple best price blending option

- Routine early engagement and dialogue with all stakeholders: state, federal and commercial payers, channel entities, data aggregators, clinics and clinicians, etc.

- Multi-State and/or Federal gene therapy support funds and risk adjustment pools

As gene therapies rapidly gain market entry with high priced, single-dose therapies, patients, healthcare and societal benefits will require all stakeholders to adapt various strategies to gain successful and sustainable traction in the marketplace.

If you are a gene therapy manufacturer or someone curious about this evolving landscape, I highly recommend you read the full white paper: Managing the Challenges of Paying for Gene Therapies – ICER

Impact of Credit Card Fees on Government Pricing: Regeneron Case

Following a whistleblower tipoff, a False Claims Act (FCA) lawsuit was filed with the US District Court in Massachusetts alleging Regeneron Pharmaceuticals, Inc., falsely calculated and submitted Average Sales Price (ASP) values. The complaint alleges Regeneron intentionally misrepresented ASP price concessions to raise the Medicare reimbursement payment limits to physicians for its drug Eylea, which treats neovascular age-related macular degeneration (Wet AMD).

The allegation resulted from Regeneron allowing physicians to pay for Eylea using credit cards and then in turn paying the credit card processing fees on behalf of the physicians. Credit card fees typically range from 2% to 3% and are uniquely widespread in the AMD space compared to other specialties. The US District Court alleges that the credit card fee payments by Regeneron benefited the physicians and did not provide any additional service to the manufacturer such that they could be considered bona-fide (and thus excluded from ASP). However, Regeneron erroneously treated these fee payments as bona-fide, thereby excluding them from the calculation of ASP resulting in a higher ASP reimbursement rate for the physicians than it ultimately should have.

To avoid similar situations from occurring, manufacturers should pay close attention to whether or not they have credit card fee payment agreement terms within their customer contracts and if so, understand how they are currently treated within their government price calculations. Additionally, manufacturers should review the various types of payments/payment terms across all their customer contracts to better understand which are considered discounts (non bona-fide) versus fees (bona-fide) and consider conducting a bona-fide service fee evaluation to protect themselves from any False Claims Act (FCA) violations.

If you have any questions or would like to review your customer contracts, please reach out to Consulting@IntegriChain.com or contact your Advisory lead.

Sources: