Regulatory Market Update

As always, if you have questions on any of the content found in this or other newsletters, please reach out to your IntegriChain Consulting Lead or advisory@integrichain.com and we would be happy to talk you through it.

Branded Pharma Fee: Manufacturer Considerations

The Branded Prescription Drug Fee (“BPDF”) was enacted with the Patient Protection and Affordable Care Act (the “Act”), and was assessed against entities engaged in the business of manufacturing or importing prescription drugs. Each company subject to the BPDF was assessed an amount based upon its relevant sales of branded prescription drugs when compared to the total relevant sales within the industry. The Internal Revenue Services (IRS) is responsible for imposing an annual flat fee on revenues starting at $2.8B (2019) on the branded pharmaceutical manufacturing sector.

Fee calculation: This non‐deductible fee would be allocated across the industry according to market share of the sale of branded prescription drugs by a covered entity during the previous calendar year for specified government programs (e.g., Medicare, Medicaid, and TRICARE) and would not apply to companies with sales of branded pharmaceuticals of $5 million or less or certain orphan drugs. Each year’s fee calculation is based on the previous year’s sales data.

Each taxpayer subject to this fee may submit a Form 8947 to provide information necessary to determine its share of the fee. The IRS will then issue a preliminary fee calculation subject to the acceptance or disagreement of the taxpayer. If the taxpayer disagrees with the preliminary calculation, it must do so in writing before approximately mid-May of the year of receipt of the preliminary calculation. The IRS will review such disputes and issue a final fee calculation by approximately August 31st of the same year.

It is important to note the fee can be waived for manufacturers of orphan drugs as long as they had previously requested and filed an “Orphan Tax Credit” via tax form 8820 (indicating the expenses incurred related to rare disease/orphan drug designation). If this was not filed at the time the expenses occurred, manufacturers should work with their tax accountant to ensure they file an amendment to the return to submit the Orphan Drug Credit in order to get the waiver for the Branded Pharma Fee.

Eligible manufacturers can anticipate receiving the final fee letter from IRS (“Letter 4658”) that will include the 2021 owed fee amount. IRS payments are due by September 30, 2021.

Sources:

Annual Fee on Branded Prescription Drug Manufacturers and Importers

Branded Prescription Drug Fee Program

Medicaid Drug Rebate Program’s 2020 Final Rule: Line Extension Updates

Including the definitions of “Line Extensions” and “New Formulations”

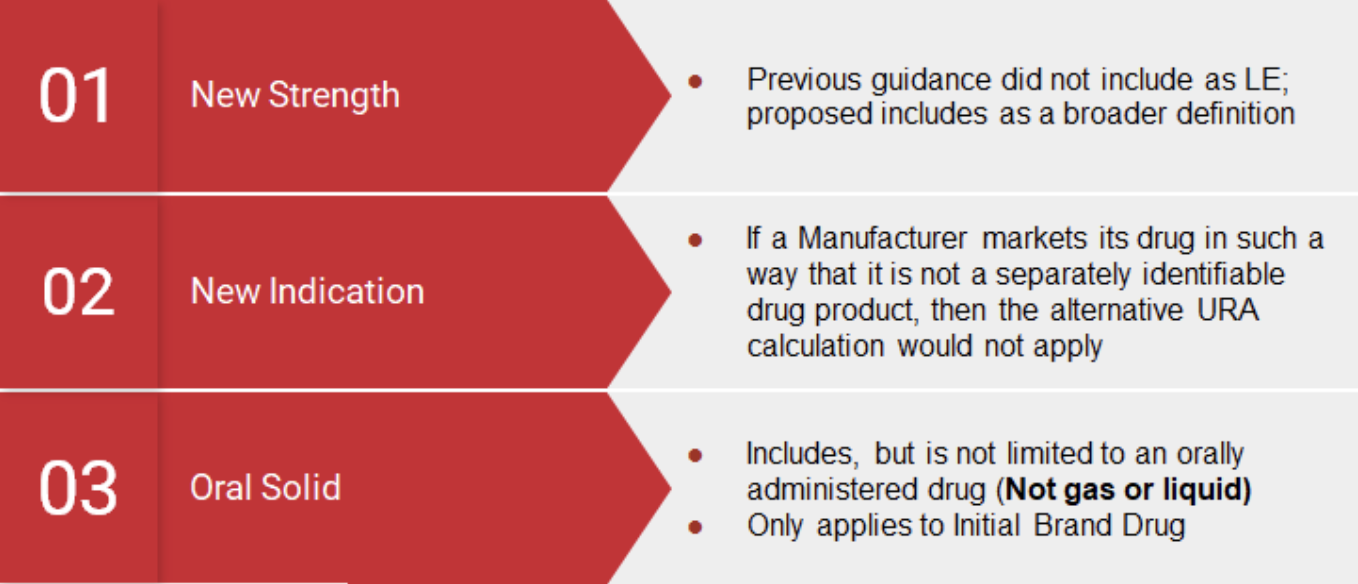

Under the Medicaid Drug Rebate Program, manufacturers are responsible for paying Medicaid Rebates on utilization of Medicaid beneficiaries based on the Unit Rebate Amount (“URA”). In 2010 the Affordable Care Act (“ACA”) amended the Medicaid Statute to apply the Alternative Rebate formula to drugs that are Line Extensions (“LE”) of an original drug. In a midnight decision in 2020, the Centers for Medicare and Medicaid (“CMS”) defined a Line Extension – New Formulation as “any change to the drug, provided that the new formulation contains at least one active ingredient in common with the initial brand name listed drug”, including but not limited to:

- Extended releases

- Change in dosage

- Change in strength

- Route of administration

- Changes in indications

- Changes in ingredients

- Pharmacodynamic/Pharmacokinetic properties

Key Notes:

- Initial brand drug must be an oral solid form

- Initial brand drug is not gas or liquid

- Line Extensions do not include abuse-deterrent formulations

- Line Extensions do not include combination products (i.e., a combination of 2 or more drugs or a drug that is a combination of a drug and medical device.

Timing: Although the Final Rule goes into effect as of January 1, 2022, with the following being considered a Line Extension, manufacturers are currently required to identify and compute products with the alternative URA if they are deemed to be an LE:

With this guidance from CMS, manufacturers should consider the following:

- Identifying products that may fall under the definition of a Line Extension and New Formulation

- Determining if there are any corporate relationships that may exist between the manufacturer marketing an original drug and manufacturer marketing the line extension drug

- Financial implications of the alternative URA on Medicaid and 340B pricing

- Documenting any assumptions to support computation of either alternative URA or standard URA

Source: Establishing Minimum Standards in Medicaid State Drug Utilization Review…

Manufacturer Awareness for Orphan Drugs

How to properly secure exclusion of PPACA expansion 340B customer class of trades from NFAMP calculations

Not all manufacturers may be aware that there is existing guidance on excluding the following customer Class of Trades from NFAMP calculations for sales of Orphan Drugs to 340B customers:

- Critical access hospitals (CAH)

- Sole community hospitals (SCH)

- Rural referral centers (RRC)

- Free-standing cancer centers (CAN)

In order for a manufacturer of Orphan drugs to exclude any 340B sales to the above COT’s, they must meet the following criteria:

- Only sales at statutory ceiling prices may be excluded (no sub-ceiling pricing exclusions

- Must offer the statutory pricing to all of these new entities (4 COTs above)

- Must commit to offering the pricing on either all of the NDCs in a product line or its entire portfolio (including all NDCs for each line item)

If the manufacturer believes they meet the above criteria, a letter must be sent to the VA to give notice of these exclusions:

- IntegriChain has successfully notified the VA on this matter in the past and has the experience and tools to achieve this quickly for any manufacturer

- If you believe your company qualifies for these exclusions or would like an assessment performed to determine eligibility, we would be happy to assist

Supreme Court Upholds ACA

Last month, the U.S Supreme Court rejected legislation against the Affordable Care Act (ACA) with a 7-2 ruling. The ACA provides health insurance to 20 million people throughout the country. The Republican party has been trying to dismantle the ACA since 2010 when it was developed under Democratic President Barack Obama. President Joe Biden stated “with millions of people relying on the Affordable Care Act for coverage, it remains, as ever, a big deal. And it’s here to stay.” Specific states like Texas tried to argue that “the individual mandate is costing them money by causing more people to enroll in the Medicaid insurance program for the poor.” Although quiet in the previous two cases, Justice Samuel Alito had a different opinion and stated, “no one can fail to be impressed by the lengths to which this court has been willing to go to defend the ACA against all threats.” In the future, there are predictions that Texas could come back and show evidence of how many people are enrolling in place but highly unlikely. It will be interesting to see what could happen in the future as litigation will continue over the Affordable Care Act.

Source: Supreme Court Rejects GOP Challenge to Affordable Care Act