Editor’s Note: Below Nick Lynch, Partner of Federal Compliance Solutions (FCS) discusses insights into recent developments in pharmaceutical pricing regulations, focusing on government programs like the 340B drug pricing program, Medicaid Drug Rebate Program (MDRP), Medicare Part B, Bona Fide Service Fees, and more.

Table of Contents

- Recent Pharma Regulatory Changes

- Key Considerations for Drug Manufacturers & Pricing

- Refresher on Bona Fide Service Fees (BFSF)

- What to Do With Pharmaceutical Pricing Regulations & How to Mitigate Risk

- Conclusion

Recent Pharma Regulatory Changes

- 2024 ADR Final Rule: This rule simplifies the Administrative Dispute Resolution process for 340B Drug Pricing Program disputes.

- Medicare Part D MDP: CMS has sent phase-in determination notices to manufacturers and released FAQs.

- 2023 Medicaid Proposed Rule: This rule proposes changes to the misclassification of drugs, program administration, and program integrity updates under the MDRP.

- HPMS Updates: Manufacturers will be required to indicate whether their P-number covers Part D only, Part B only, or Part B and D drugs in HPMS. Manufacturers will also be required to enter 2 new contacts in HPMS by October 31, 2024 and 3 additional contacts relating to the Inflation Rebates in HPMS by December 15, 2024.

- New Manufacturer Discount Program: Any Manufacturers currently participating in the new Manufacturer Discount Program must make sure all participating company labeler codes are up-to-date in HPMS by November 1, 2024 in order to see this reflected on the January 2025 published participating labeler code list.

- Medicare Part B: Manufacturers that will cover Part B only drugs and who do not currently have a P-number, will be required to register for one. Reference CMS memo provided on September 13, 2024 for instructions.

- Government Program Calculation and Reporting Updates: These include changes to the 1Q 2024 URA calculations, OPAIS 340B Pricing Component, ASP Data Collection System, and FAS SRP for FSS Sales Reporting.

- State Pricing Transparency Reporting: These include changes to Oregon’s assessment fee structure for manufacturer payments to support the state’s Drug Price Transparency Program as well as notifications sent from Washington’s Drug Price Transparency Program and reminders around upcoming reporting.

Key Considerations for Drug Manufacturers & Pricing

- 340B Program: Manufacturers should be prepared to respond to CEs regarding contract pharmacy restrictions.

- Medicare Part D MDP: Review the phase-in determination and FAQ information, and submit a recalculation request if necessary.

- MDRP: Understand the proposed rule changes, evaluate their impact, and take action to manage potential challenges.

- Government Program Calculations: Implement changes related to the AMP cap removal, OPAIS enhancements, ASP Data Collection System, and FAS SRP.

- Bona Fide Service Fees: There continues to be a lot of focus on pharma manufacturers and their arrangements with third-party service providers and how the fees are treated in government pricing (i.e., included as a price concession or excluded as a Bona Fide Service Fee (BFSF). We’ve included a quick refresher on BFSF and a few key considerations (see our recent BFSF blog for additional details and insights).

For more Government Pricing Updates.

Refresher on Bona Fide Service Fees (BFSF)

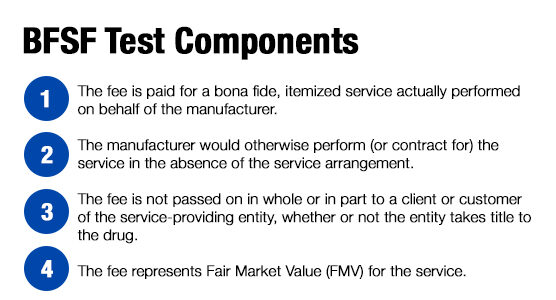

Pursuant to 42C.F.R.§447.502, the definition of BFSF for purposes of Average Manufacturers Price (AMP), Best Price (BP), and Average Sales Price (ASP):

Fees paid by a manufacturers pricing fees to an entity that represent fair market value for a bona fide, itemized service actually performed on behalf of the manufacturer that the manufacturer would otherwise perform (or contract for) in the absence of the service arrangement and that are not passed on in whole or in part to a Company or customer of an entity, whether or not the entity takes title to the drug.

Figure 1 – Bona Fide Service Fees (BFSF) Test Components

What To Do With Pharmaceutical Pricing Regulations & How to Mitigate Risk

- Inventory your contracts and evaluate if you have sufficient BFSF documentation.

- Document your BFSF evaluation, follow your BFSF process, perform FMV, and ensure that fees and other payments (including admin fees, credit card fees, distribution fees, data fees, other service fees, etc..) are treated appropriately based on the results of the BFSF evaluation. As a reminder, there is no conservative approach for BFSF (i.e., depending on your product, what’s conservative in one government program may be aggressive in another). Note we generally recommend checking with counsel; especially for new or complex arrangements, if it’s your first evaluation, or if it’s a sensitive matter that should be performed under privilege.

- Develop processes and incorporate tools (i.e., checklist/questionnaires/FMV estimators) to help facilitate and incorporate BFSF evaluations in the contracting process. This is a key item to help ensure that service arrangements are being evaluated not only from a fair market value perspective but taking a close look at the qualitative prongs of the test (i.e., is this a service on our behalf, is their pass-through evidence or notice, services itemized in the contract) and having a framework in place for the evaluation including when to seek counsel advice. In practice, we’ve seen it work well when manufacturers incorporate BFSF review as part of the contracting process to ensure appropriate stakeholders are aligned and there are no surprises when it comes to government pricing or gross to net. Also, for large manufacturers and or manufacturers that do a lot of contracting, think about ways to modernize and streamline the process.

- Perform periodic BFSF/FMV training so business teams are aware of the process and mindful of current rules, regulations, and that the company creates and maintains documentation of the BFSF analysis and treats the fees appropriately in government pricing.

- Monitor and track performance of service providers and overall spend and evaluate whether there’s an opportunity to mitigate risks.

- If your contracts allow the vendor to invoice net of service fees, discounts, and other adjustments on their invoices, ensure that you’re reviewing them and treating the fees appropriately. Note this is an area that is commonly overlooked especially as it relates to items like price appreciation credits. It’s important to note that CMS has made clear that price appreciation credits are not BFSF and should be included in calculations

- Perform periodic government pricing assessments to ensure calculations are accurate and complete, appropriate reasonable assumptions and methodology are documented, policies and procedures are current, and service fee treatment in calculations aligns to BFSF documentation and that all service arrangements are reviewed.

- If you’ve already performed FMV and BFSF evaluation, keep track and perform periodic refreshes as needed. We typically recommend every 2-3 years, unless something significantly changes (i.e., sales or service changes, new rules/guidance, etc.).

Conclusion

Staying informed about these regulatory changes is crucial for drug manufacturers pricing to comply with government programs and manage their pricing strategies effectively.

Learn more about BFSF’s and SPTR at Access Insights. Register here.

Reach out to your IntegriChain contact or consulting@integrichain.com for further understanding of the potential impacts of pharmaceutical pricing regulation impacts.